child tax credit 2021 income limit

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The credit can be worth up to 2000 per child and it can be used to offset taxes owed.

What Is The Child Tax Credit Tax Policy Center

The child tax credit CTC will return to at 2000 per child in 2022.

. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. These people are eligible for the. Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not eligible for the credit.

The new Child Tax credit phases out with income in two different steps. 150000 if you are married and filing a joint. The American Rescue Plan Act expands the child tax credit for tax year 2021.

The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021. The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

What is the income limit for the child tax credit 2021. The first phaseout can reduce the CTC to 2000 per child. Have been a US.

The Child Tax Credit limit is 75000 for single filers and 110000 for joint filers. 150000 if married and. The maximum credit amount has increased to 3000 per qualifying child between.

The second phaseout can reduce the. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a.

Step 1 phaseout. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to 3600 for children under.

June 14 2021. For 2021 eligible parents or guardians. The credit amounts will increase for many.

The Child Tax Credit changes for 2021 have lower income. The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. A childs age determines the amount.

The Child Tax Credit begins to be reduced to 2000 per child when the taxpayers modified adjusted gross income in 2021 exceeds. Families that do not qualify for the credit using these lower income limits are.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Verify If You Had A Baby Last Year And Didn T Get Extra Child Tax Credit Money Can You Get It By Filing Taxes 12newsnow Com

Tax Credit Expansions In The American Rescue Plan

Romney Child Allowance Child Tax Credit Proposal Tax Foundation

The Child Tax Credit Research Analysis Learn More About The Ctc

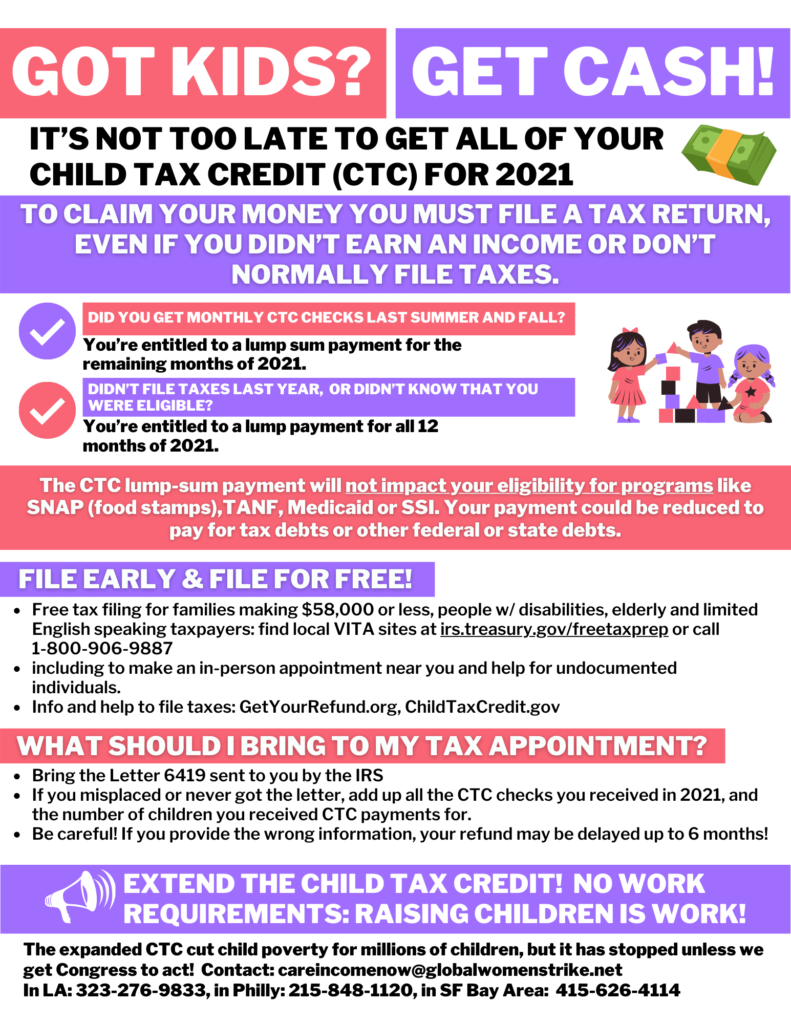

2021 Advance Child Tax Credit Payments Start July 15th Missouri Legal Services

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

The American Families Plan Too Many Tax Credits For Children

The 2021 Child Tax Credit John Hancock Investment Mgmt

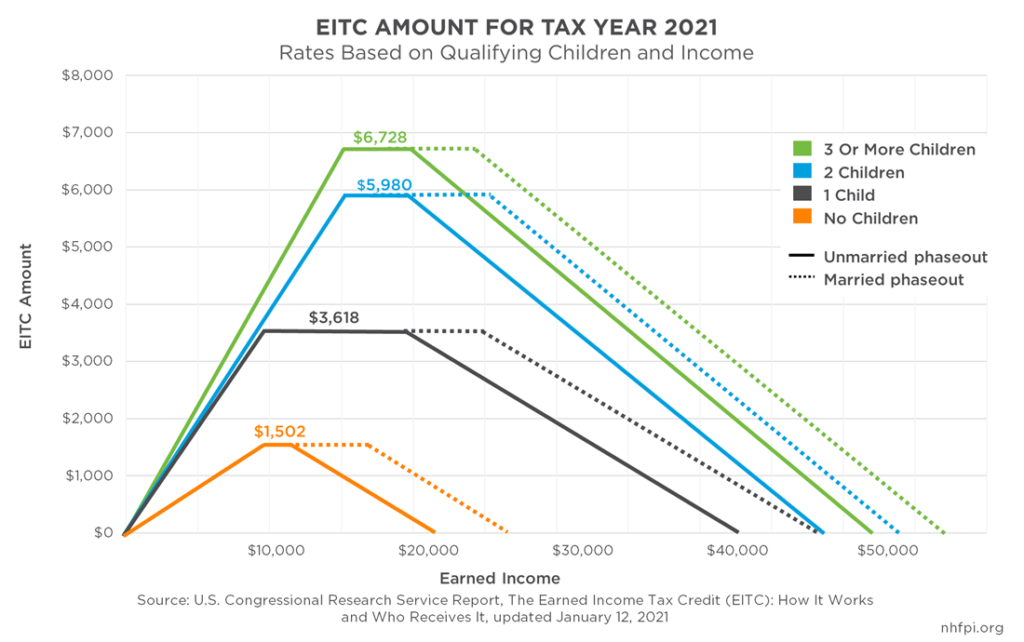

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What To Know About The New Monthly Child Tax Credit Payments

Eitc Tax Credit Helps Working Families Nj 211

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

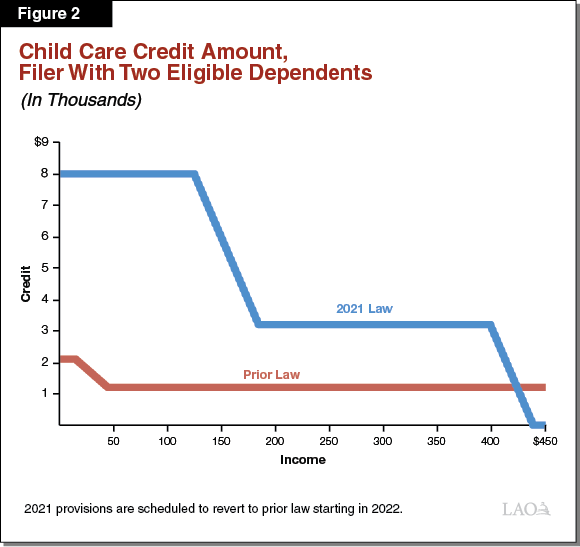

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

The Child Tax Credit The White House

Take Action Child Tax Credit Earned Income Tax Credit Awareness Day Global Women S Strike Wages For Housework Selma James

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning